Data on real-time ESG is important

Generally, if we want to change something, we need to know where we are starting from, and we need to be able to measure the changes that are happening. This is what real-time ESG is all about and why it is important: if we can measure it, we can manage it – if we can manage it, we can drive improvements, calculate return on investment, and create competitive frameworks through peer comparisons to drive change.

Measure it, manage it, improve it!

Measuring compliance with ESG standards in real-time enables us to know where we are, and then also to see incremental changes as they happen. And changes can be for the better or for the worse – but whatever changes, we can see it – and we can reward it if appropriate – and we can do something about it.

How do we measure “ESG”?

If we cannot measure compliance with ESG standards, how can we hold companies to account? Measuring ESG compliance is difficult, especially if the goal is to be fully objective, impartial and to avoid “greenwashing”. Greenwashing is a term used when companies claim compliance with ESG standards but are actually not delivering. In our experience, very few businesses deliberately seek to obscure their performance – it is just that rigorous measurement of compliance with ESG standards is very difficult to achieve.

ESG version 1.0 measurement systems have been developed over the last 30 years and there are some very large and well-capitalised service providers operating on a global basis. Systems have developed over decades that are largely based on annual surveys and evidence-based self-certification. This provides base-line data, perhaps once each year – allowing a foundation to be established and then change to be measured. The main issue with this model is that it is relatively easy to abuse – but on the other hand, it is the best that we have and the one that largely will continue as the bedrock for ESG compliance, control, and improvement going foward. And continued investment in process and systems around the concept of the annual review will improve these systems as every year goes by. Companies like Ecovadis, Bureau Veritas, Sustainalytics, Reprisk etc. are well-known global providers of services in this space.

A new breed of ESG measurement systems is emerging: ESG version 2.0 or “real-time ESG”. These are provided by technology-driven companies that aim to deliver ESG measurement at the level of the individual supply chain, a single workplace, even down to a single “SKU” 0r stock-keeping unit shipped to a business. Measurement at this level is only possible with technology – but starts to deliver a level of granularity that is much harder to greenwash and capable of real-time responsiveness. And with real-time responsiveness comes the ability to drive change incrementally all the time, rather than based upon annual snapshots.

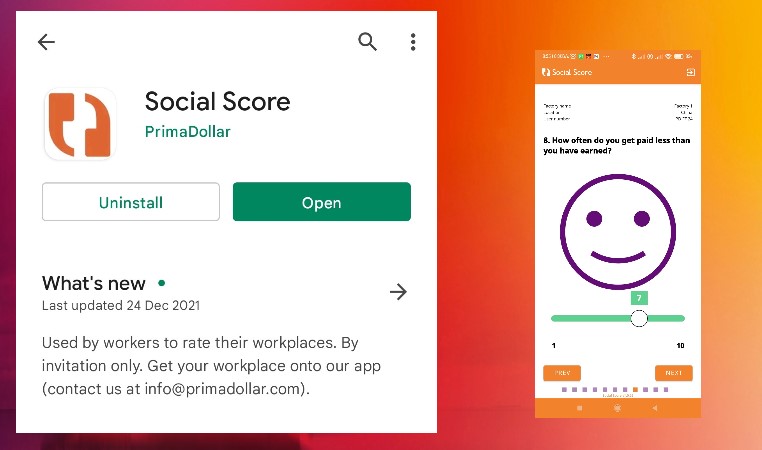

To see more about our worker app, click: here.

ESG version 2.0 is real-time – how does it work?

We deliver real-time ESG data for the “S” and “G” of ESG. This can be done in a standardised, benchmarked and global fashion – across industry, geography and workplaces including factories, farms and fields.

- Our worker app goes onto the mobile phones of workers. We reward workers for providing us with responses to questions about their workplaces. Our question panel is very broad and enables us to capture data points across the full spectrum of the workplace conditions.

- With worker responses arriving continuously, anonymously and in real-time, we are able to compile a social score on the workplace and maintain a significant amount of diagnostic information.

- Workplaces, their corporate customers and finally the end-consumers of their products or services are able to see social scores on their suppliers – compare them and understand them

- Social scores and related diagnostic data are published via API with the consent of the workplace involved – and can be embedded in trade finance / supply chain finance platforms, websites, and even delivered directly in store to consumers browsing products.

This is real-time “S” and “G”. Real-time “E” is more complicated because it varies by product, geography and supply chain. This is because every material is, ultimately, different and every geography has different environmental constraints and issues to manage. However, there is a lot of investment going into determining the environmental components of different supply chains, broadly following a straightforward model:

- Sourcing and sustainability of raw materials – where are materials coming from and what are the environmental implications of their production and delivery (energy, water, pollution, use of resources)?

- Processing and production – how are raw materials transformed into finished products and what are the environmental implications of that process (as previous)?

- Transport and delivery – how are materials moved to their end consumer and what is involved (energy, carbon footprint)?

- End of life – how are products re-circulated back into productive use by recycling and repurposing them?

As already mentioned, measuring real-time “E” is much more of a bespoke process by industry, product, supply chain and geography – but significant investment is going into these processes.

And where do we end up?

Imagine walking into a shop and scanning a QR code on a product which shows you:

- Who made it and how they are treated (real-time S and real-time G)?

- What it is made of, and for each component, sustainability data on its sourcing and recycling data at end of life?

- And how it arrived to be in front you right now?

This is not far away. The first products delivering real-time S and real-time G data in this fashion will be shops before the end of 2022.

How can I find out more?

ESG is really important:

Source: PwC survey on consumer and investor expectations around ESG (click here).

With a global network and global coverage, talk to us.

and

Sign Up For Insights

Trade finance developments, announcements, new technology and new partners - find out about it by signing up here.

Apply here